Navigating Home Renovations and Financial Support After Losing a Partner in a Car Accident

Losing a life partner in a car accident is an unimaginable tragedy, plunging individuals into a vortex of grief, sorrow, and profound emotional turmoil. Amidst this heartbreak, the practical realities of life often feel insurmountable, particularly financial concerns like managing and funding home renovations. Yet, the process of adapting your living space can be a crucial step in healing, offering a tangible way to create a sanctuary that supports your new reality and future.

This comprehensive guide is designed to gently walk you through the complex landscape of available financial resources, legal avenues, and practical strategies. Our aim is to ensure you have the necessary support to rebuild not just your home, but also your life, providing clarity and comfort during an exceptionally challenging time.

Understanding and Navigating Insurance Claims After a Fatal Car Accident

While the emotional burden of losing a partner is overwhelming, successfully managing the aftermath of insurance claims doesn’t have to add to your stress. This critical first step can provide the financial foundation for your future stability, including vital home improvements.

Initiating Your Claim: The Essential First Steps

Prompt action is key. As soon as you are emotionally able, gather all essential documents. These typically include the official police report from the accident, your partner’s death certificate, and any relevant medical records or autopsy reports. These documents form the bedrock of your insurance claim and will be indispensable for all subsequent steps.

Next, reach out to the relevant insurance companies involved—this could include your own auto insurer, the at-fault driver’s insurer, and your partner’s life insurance provider. They will be able to explain policy specifics, coverage limits, and the exact procedures for filing a claim. Be prepared for a series of communications; persistence and meticulous record-keeping will serve you well.

Seeking Legal Counsel: When and Why it Matters

The complexities of insurance law and the emotional weight of your situation make consulting an attorney specializing in wrongful death claims or personal injury law highly advisable. An experienced lawyer can be invaluable if complications arise, if you suspect an unfair settlement offer, or if the at-fault party’s insurance company is uncooperative. They can help you understand the full scope of potential compensation, including:

- Accidental Death Benefits: Often part of auto insurance policies or separate life insurance policies.

- Lost Income Support: Compensation for your partner’s lost future earnings and contributions to the household.

- Medical and Funeral Expenses: Coverage for costs incurred due to the accident and burial.

- Pain and Suffering: While difficult to quantify, some policies and lawsuits may cover emotional distress.

- Property Damage: For any damage to your vehicle or other property.

Always document every conversation, email, and letter with insurance adjusters or legal representatives. Keep a detailed log of dates, names, and summaries of discussions. This comprehensive record will be crucial during negotiations and can protect your interests in the long run, helping you secure the necessary funds smoothly and without unwelcome surprises.

A fair insurance settlement provides not only immediate financial relief but also the means to begin practical projects, such as home renovations. With adequate funds, you can transform your living space to better suit your new reality, create an environment conducive to healing, or finally pursue long-held dreams for your home, adapting to changes in household income or personal needs.

Pursuing Comprehensive Compensation: Beyond Basic Insurance

After the devastating loss of a partner, financial security might feel incredibly fragile. It’s essential to explore all possible avenues for compensation to ensure long-term stability and support your journey toward healing and rebuilding.

Wrongful Death Lawsuits: Seeking Justice and Damages

A primary avenue for further compensation is a wrongful death lawsuit against any parties deemed at fault for the accident. Eligibility to file such a lawsuit varies by state and relationship to the deceased, but generally, immediate family members can pursue this claim. To strengthen your case, gather extensive evidence, including:

- Detailed police reports and accident reconstruction analyses.

- Eyewitness accounts and statements.

- Photographs and videos from the accident scene.

- Medical records, autopsy reports, and expert medical testimony.

- Financial documents demonstrating your partner’s past and projected future income.

Building a robust legal claim requires the expertise of a seasoned car accident lawyer who understands local laws and has extensive experience navigating similar situations. They can help value your claim, negotiate with defense attorneys, and represent your interests in court, striving to secure just compensation for both economic (e.g., lost income, medical bills, funeral costs) and non-economic damages (e.g., pain, suffering, loss of companionship).

Exploring Additional Survivor Benefits and Support

Beyond insurance claims and potential lawsuits, consider other benefits you may qualify for:

- Social Security Survivor Benefits: If your partner worked and paid Social Security taxes, you or your dependent children may be eligible for monthly benefits. Eligibility depends on factors like your age, the age of any children, and your income.

- Pension and 401(k) Survivor Benefits: Many employer-sponsored retirement plans offer survivor benefits. Contact your partner’s former employer or plan administrator to understand your entitlements.

- Life Insurance Policies: Check if your partner had any individual or employer-provided life insurance policies, separate from auto insurance, that you are the beneficiary of.

- Employer Benefits: Some companies offer death benefits or extended support to the families of deceased employees.

- Veterans’ Benefits: If your partner was a veteran, you might be eligible for specific benefits from the Department of Veterans Affairs.

Adopting this multi-faceted approach ensures that no potential source of financial support is overlooked. Achieving fair and comprehensive compensation offers a crucial layer of stability during this incredibly difficult time, paving the way for essential projects like home renovations that can truly adapt your living environment to your evolving needs and promote healing.

Exploring Financial Resources for Your Home Renovation Projects

Securing funds for home renovation after such a significant loss requires both creativity and persistence. It’s wise to evaluate all your available resources and consider multiple options to cover the costs, as combining various sources can often optimize funding while minimizing financial strain.

Key Financial Avenues to Consider:

Here are several financial avenues that can help fund your renovation projects:

-

Home Equity Loans and Lines of Credit (HELOCs)

These financial products allow you to borrow against the equity you’ve built in your home. They often come with more favorable interest rates compared to other types of loans because your home serves as collateral. A home equity loan provides a lump sum, while a HELOC offers a revolving credit line you can draw from as needed. Using an EMI calculator for home loans can help you accurately estimate your potential monthly repayments, enabling responsible budgeting.

-

Government Grants and Assistance Programs

Explore local, state, and federal programs that offer grants specifically aimed at helping homeowners improve their living spaces. These grants often don’t need to be repaid and can be targeted towards specific needs such as energy efficiency upgrades, accessibility modifications (e.g., for age-in-place initiatives), or structural repairs. Eligibility criteria can vary significantly based on income, location, and the nature of the renovation, so thorough research is essential through HUD, state housing authorities, or local community development offices.

-

Personal Savings and Investments

Tapping into personal savings or liquidating certain investments could be a viable option, especially if interest rates on borrowing are high or if you prefer to avoid taking on new debt. It’s important to carefully assess your overall financial liquidity and consult with a financial advisor to ensure this approach doesn’t compromise your long-term financial security.

-

Community Assistance Programs and Non-Profits

Many communities have non-profit organizations, charities, or faith-based groups dedicated to aiding individuals facing unexpected tragedies. These programs may offer direct financial assistance, volunteer labor for renovations, or guidance to other support services. Check with local social services, community centers, or specific grief support organizations for potential leads.

-

Specialized Home Improvement Loans

Financial institutions often offer specialized loans tailored specifically for renovations. Unlike home equity loans, some home improvement loans can be unsecured (meaning no collateral required, though they may have higher interest rates) or secured by the project itself. Programs like the FHA 203(k) loan are government-backed options that allow you to borrow money for both the home’s purchase or refinance and its renovation costs, all wrapped into one mortgage.

-

Crowdfunding Campaigns

Platforms like GoFundMe or similar services allow you to create a campaign and reach out to friends, family, and the wider community who may be willing to contribute financially towards your renovation efforts. This can also serve as a powerful way to garner emotional support during your healing process.

By strategically piecing together resources, researching each option thoroughly before committing, and potentially combining several sources, you can optimize overall funding. This approach minimizes financial strain during an already challenging period, turning your renovation plans into reality without compromising your future stability.

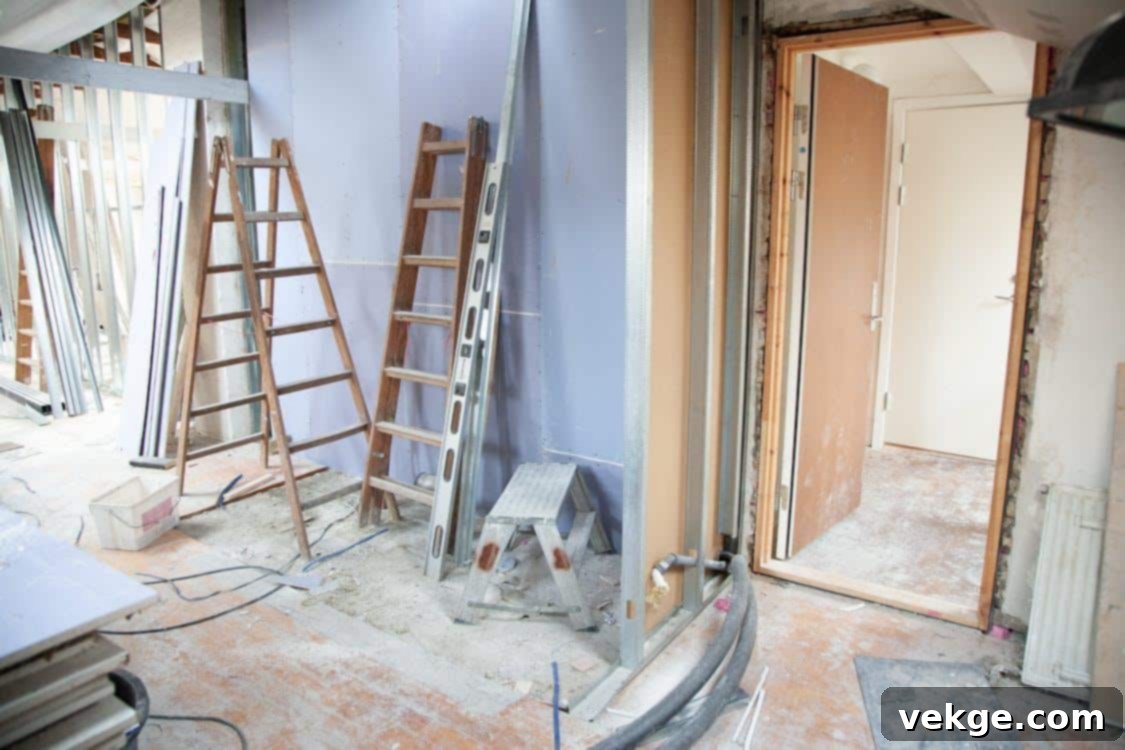

Budgeting and Planning Your Renovation for a Healing Home

Once you have a clearer picture of your financial resources, meticulous budgeting and thoughtful planning become paramount. A well-executed renovation can transform your home into a haven of comfort and healing, but it requires careful consideration.

Creating a Detailed Budget and Prioritizing Needs

Start by outlining every aspect of your desired renovation, from major structural changes to cosmetic updates. Obtain multiple quotes from reputable contractors for each phase of the project. Prioritize renovations based on immediate needs versus long-term desires. For instance, creating a more accessible bathroom might be a priority over a purely aesthetic kitchen upgrade. Always allocate a contingency fund, typically 10-20% of your total budget, to cover unforeseen expenses that often arise during renovation projects.

Designing a Space for Solace and New Beginnings

Consider how your home can best support your emotional well-being. This might involve creating a dedicated quiet space for reflection, reconfiguring rooms to feel more open and light, or incorporating elements that honor your partner’s memory in a comforting way. The goal is to create an environment that fosters peace, growth, and a sense of renewal, rather than dwelling on loss.

Emotional Well-being and Support During Your Journey

While practical steps are crucial, remember that navigating grief while managing significant life changes like home renovations can be intensely draining. Allow yourself grace and seek emotional support when needed.

- Grief Counseling and Support Groups: Professional counseling can provide strategies for coping with your loss, and support groups offer a community of individuals who understand your experience.

- Family and Friends: Lean on your support network for emotional comfort, and don’t hesitate to ask for practical help with renovation tasks or daily chores.

- Pace Yourself: There’s no rush to complete renovations. Take breaks, listen to your body and mind, and move forward at a pace that feels manageable.

The journey of losing a partner and rebuilding your life, including your home, is a marathon, not a sprint. By thoughtfully addressing both the financial and emotional aspects, you can create a resilient foundation for your future and a home that truly serves as a sanctuary for healing and new beginnings.